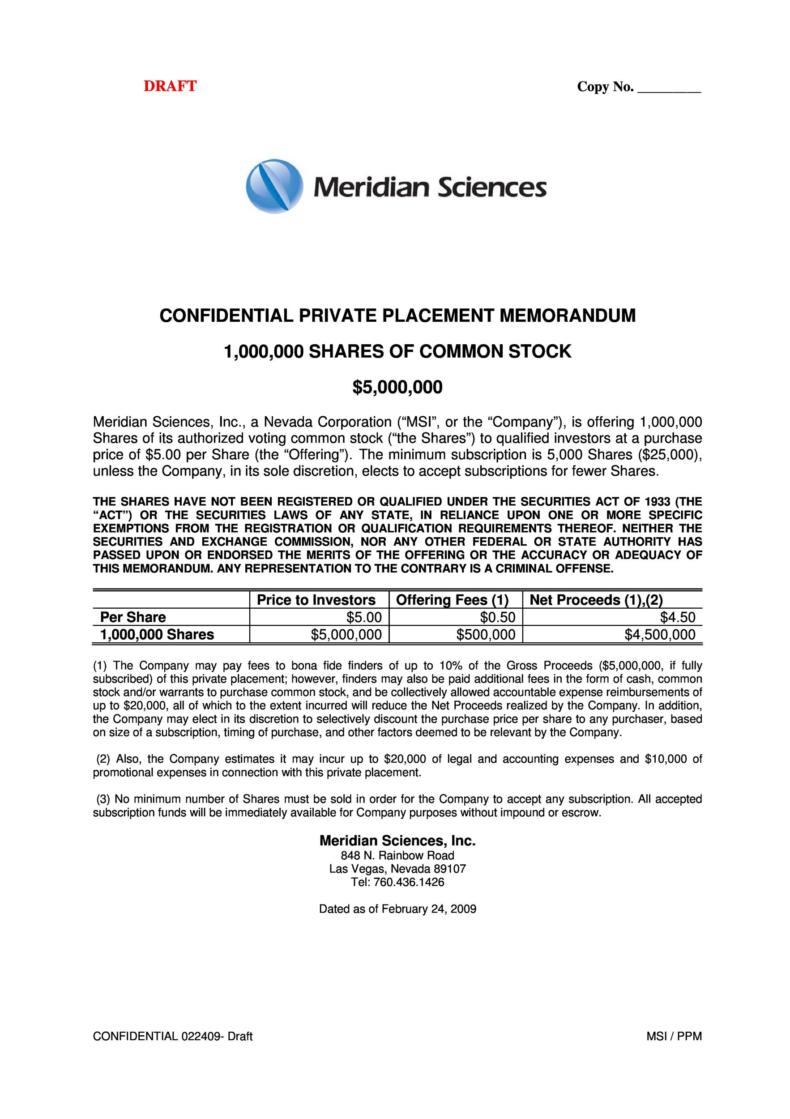

Any restrictions on who can invest (e.g., accredited investors only).How the funds will be used (e.g., to expand operations or launch new products).The type of security being offered (e.g., common stock or preferred shares).Additionally, it should explain any restrictions on who can invest in the offering and what rights come with investing in it.įor example, if a company is raising $10 million dollars through a PPM, they may include information such as: It should also provide details about the offering, such as the amount being raised and how it will be used. Here’s what you can expect: IntroductionĪ PPM introduction should include a summary of the company, its purpose, and the type of securities offered.

No matter the type of PPM, they generally contain the same set of elements. Count financing authority bond sales : Issued to raise funds by selling bonds.Įach type of PPM presents its unique path to financial growth and adventure.LLC promissory notes : Notes secured by investment funds.Corporation common stock sales : Issued to raise capital by selling corporate common stocks.Mutual fund shares held by a trust : A trust acts as the investor and acquires shares in a mutual fund on behalf of its beneficiaries.Mortgage broker business notes : Issued by mortgage broker businesses to solicit investments from lenders.Here’s a quick breakdown of the different types of documents you may come across : After receiving the PPM, potential investors review the document, analyze the disclosed information, and might seek additional clarification or advice from legal or financial professionals. This typically involves distributing the document to prospective investors interested in the investment opportunity. Once completed, the company must ensure it reaches the intended investors. Moreover, obtaining a PPM falls on the company seeking investors. Rather, it’s a disclosure document designed to protect the issuing company and the potential investors. It ensures investors are aware and informed.īut it’s important to note that a PPM is not a sales document. Definition of Private Placement Memorandum (PPM)Ī private placement memorandum is a legal document that serves as an all-inclusive guide, detailing everything from the company’s overview to the investment offering, the risks involved, and the fine print (legal terms and conditions). However, whether you’re looking for a Private Placement Memorandum or not, it’s essential to understand what a PPM is and why you may need one. Generally, only individuals investing in risky securities such as private placements must review a PPM before making an investment decision. While not every investor will come across this particular document, those venturing into private investments may find it essential. Amidst this sea of investing paperwork, one document stands out for its unique role in certain investment scenarios - the Private Placement Memorandum, or PPM.

0 kommentar(er)

0 kommentar(er)